When earnings season is in full swing, every investor has his favorite setup to trade and follow.

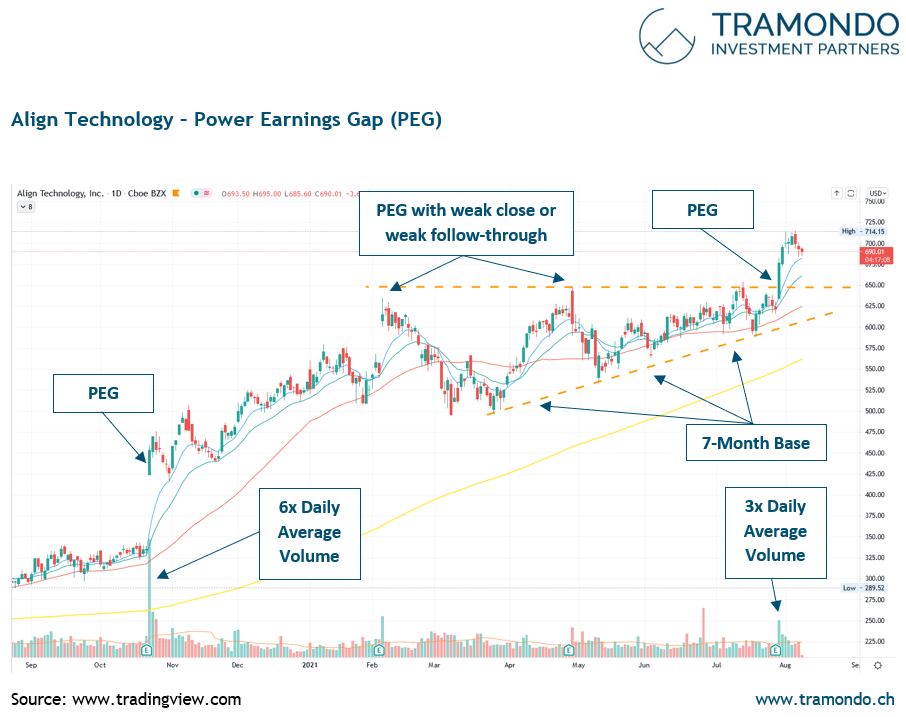

At Tramondo, our favorite setup is the “Power Earnings Gap” – in short we call it “PEG”, which was originally created by @traderstewie.

Why? Because a “PEG” highlights so many traits of very successful companies and works best with high growth stocks.

A “PEG” is basically:

- A stock that gaps up after reporting strong earnings and closes the day by printing a strong candle (best is a close near highs)

- Preferably, the stock makes new all-time-highs or 52-week highs and breaks out from at least a month’s range

- Volume needs to be huge -> at least 3-5x daily average, we want to see other institutions next to us piling into the name

- A stock that gaps up on strong earnings only to reverse and close weak or in the red is not what we want to see

PEG-stocks are very attractive candidates for watchlists, top-up positions or aggressive trades. In line with our investment credo “Good Story, Good Chart”.

However, we suggest leaving the more aggressive trades to very experienced investors, as volatility tends to be very high on these days and stocks can sell-off very sharply.

A picture is worth a thousand words, so let us show you some chart examples of the most recent earnings season: Nike (Chart 1), Snap (Chart 2) as well as Align Technology (Chart 3) with several “PEG” showing its trickiness, too.